Whenever I read an article touting an announced financial aid policy that eliminates tuition for students whose family incomes are below a specified amount, I cringe.

Many reporters appear to have forgotten that tuition is not the only cost of attending college. Moreover, no one attempts to check the potential impact in advance.

Financial Aid Practices by Institutional Groups

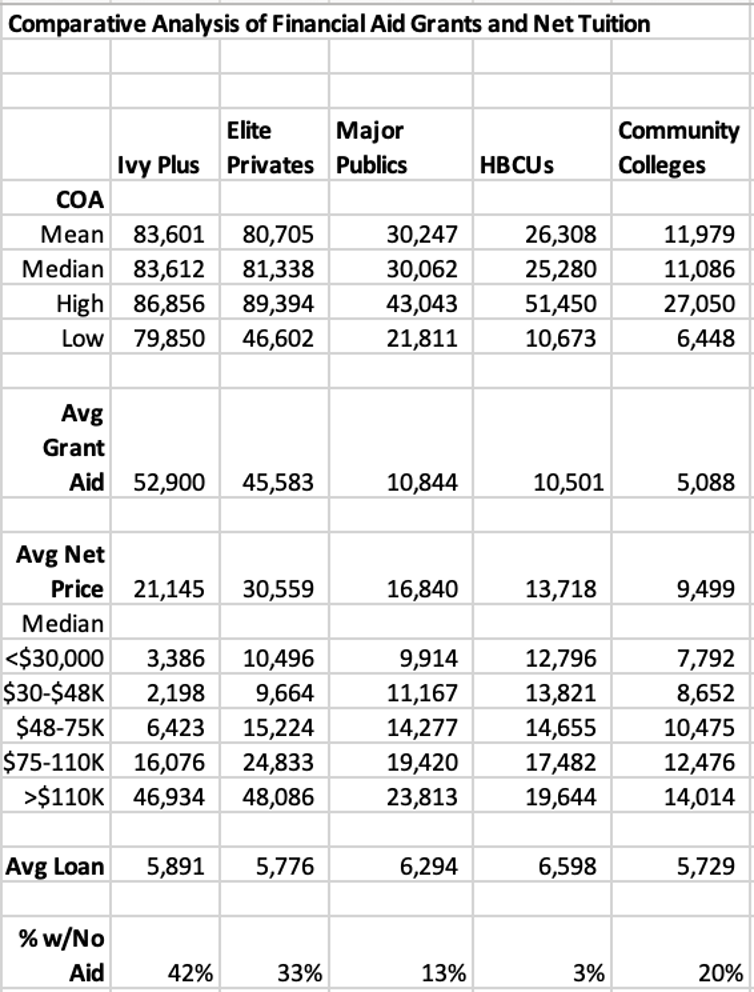

A little over a year ago, I wrote articles about the financial aid practices at Ivy Plus institutions, other elite private colleges and universities, major public universities, HBCUs, and community colleges.

The findings were eye-opening.

The 12 Ivy Plus colleges and universities arguably charge the highest tuition of any group of colleges in the U.S. They have the most selective admissions policies and the highest endowment balances of any group of colleges. Thanks to their healthy endowments, they provide the lowest net prices for students with the lowest income.

Each of the blog articles that I wrote includes many tables about the different groups of colleges and universities. The data was collected from College Navigator during the summer of 2023 and does not reflect the current year’s data.

In the table below, I compare several undergraduate data points for each of the groups. Unless otherwise presented, each data point represents the median for the group. As you can clearly see, the highest COAs (cost of attendance) belong to the most elite privates, with the 12 Ivy Plus institutions edging out the other elite colleges and universities.

Two other points align with the premium pricing strategies of these two groups. The median grants awarded to the students are the highest ($52,900 and $45,583), and the percentage of students who receive no aid (full-pay) is the highest (42% and 33%).

The last category I want to point out is the net price (COA minus total grants, institutional, federal, and state) for each family income quintile. The average family of four in the three lowest quintiles ($0-$75,000) will find it difficult to pay anything for college.

The 12 Ivy Plus universities have the lowest net price for the three lowest income quintiles. Their large endowments and generous financial aid policies allow them to award more grant aid to these lower-income students than any other group. The next lowest net prices belong to the top 50 community colleges I analyzed.

In their case, their much lower COA allows them to lower the net price with much lower grants than any other group. The highest net prices for these lowest three quintiles belong to the HBCU group. It is likely that their available financial aid does not allow them to extend more generous grants to the lowest-income students.

MIT’s Free Tuition Offer

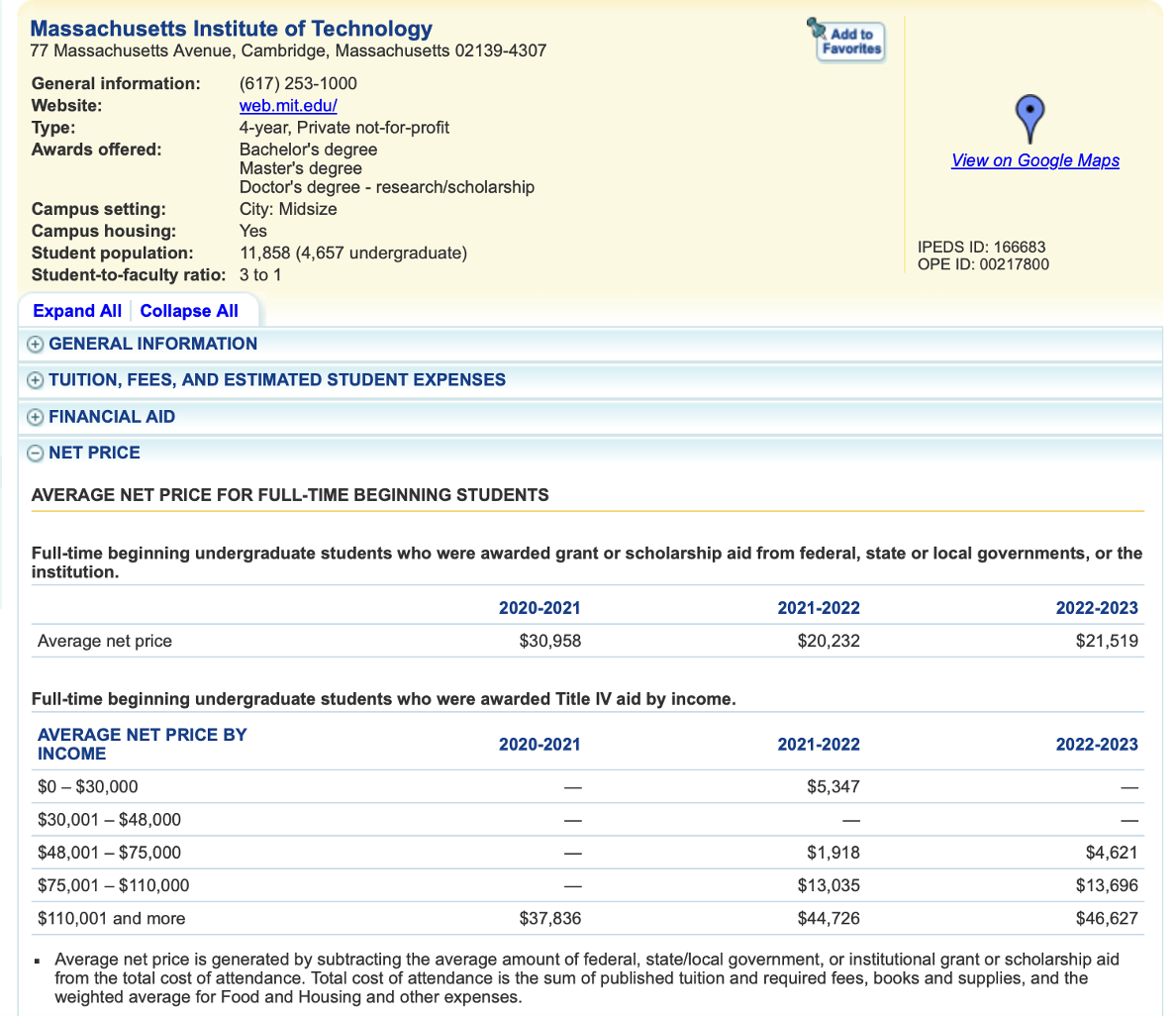

The Massachusetts Institute of Technology is a member of the Ivy Plus schools that already provide a lower net price for the lowest-income students. Last Wednesday, MIT announced that it would provide free tuition to students whose family income is less than $200,000 and cover costs such as housing, dining, fees, and books for students whose family income is less than $100,000.

MIT’s net price is already $0 for the lowest two quintiles of family income. Their offer of paying all other costs for families under $100,000 should add another $0 to the third income quintile.

See the screenshot below from MIT’s current College Navigator net price data.

According to MIT, 87% of the students who applied for financial aid graduated without student loans last year. Only the wealthiest and most selective institutions can implement these generous funding policies. Non-selective institutions would risk having an unlimited number of students qualify compared to these selective institutions who accept few applicants.

University of Texas System Announcement

Last week, the University of Texas System announced that its Board of Regents Academic Affairs Committee gave preliminary approval to provide tuition-free education to Texas resident UT undergraduates attending any of its nine academic institutions whose families have an adjusted gross income of $100,000 or less beginning next fall.

The UT System announcement expands the existing Promise Plus endowment and its income eligibility from $65,000 to $100,000. Recipients must be full-time students, residents of Texas, and apply for financial aid.

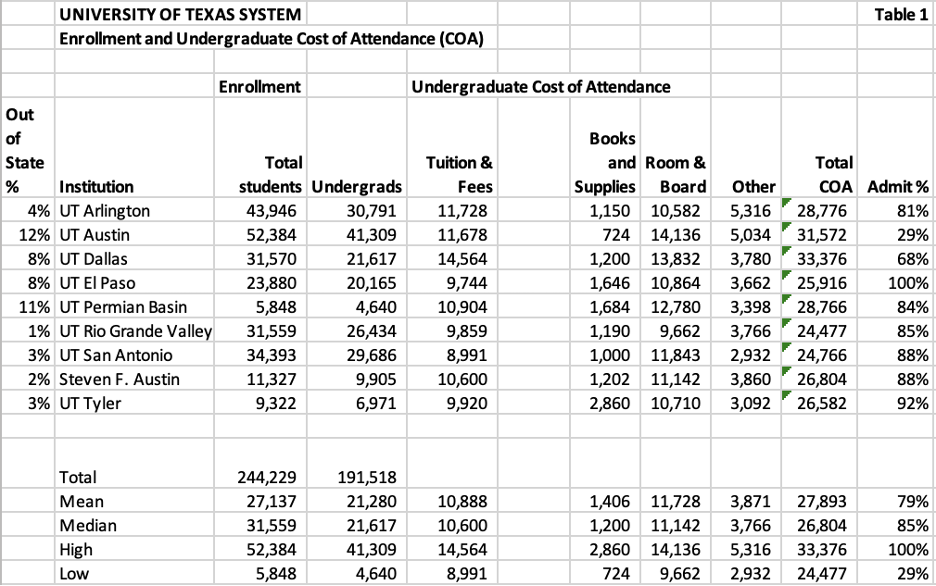

In Table 1 below, I provide an overview of the nine UT System academic institutions using data from College Navigator. The nine enroll a total of 244,229 students, 191,518 of whom are undergraduates. UT Austin has the largest enrollment (52,384).

UT Austin also has the highest percentage of out-of-state students (12%) and is the most selective, admitting only 29% of applicants. UT Dallas has the highest cost of attendance ($33,376), and UT Rio Grande Valley has the lowest COA ($24,477). UT Permian Basin has the lowest enrollment (5,848).

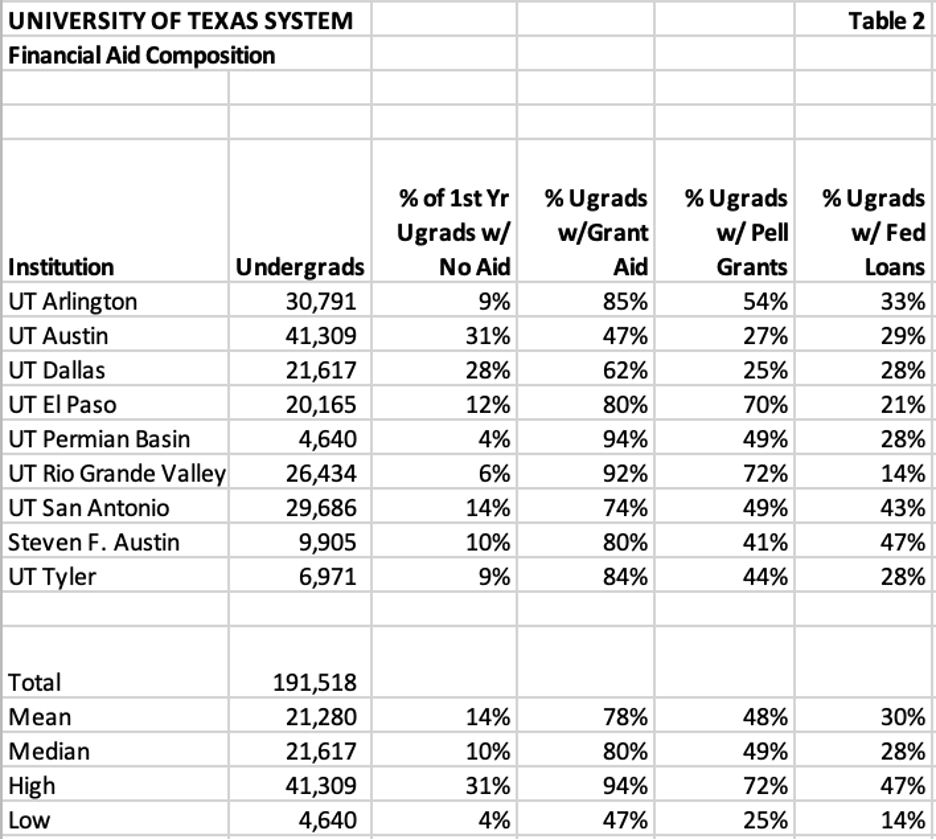

Table 2 provides an overview of the composition of first-year, full-time students who receive financial aid at each of the nine institutions. The percentage of students with no aid ranges from a high of 31% at UT Austin to a low of 4% at UT Permian Basin. The percentage of students with Pell Grants ranges from a high of 72% at UT Rio Grande Valley to a low of 25% at UT Dallas.

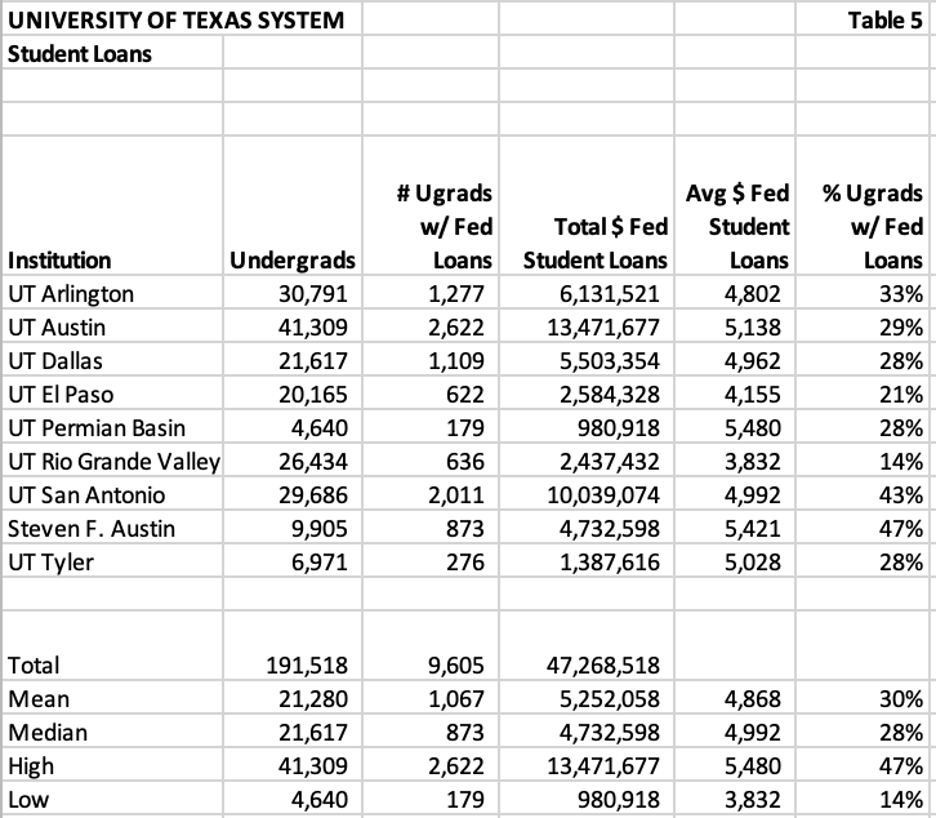

The Texas Higher Education Coordinating Board has an objective that 60% of its institutions’ graduates will have no student loan debt. The UT System has contributed to that goal with a median of 28% of students with student loans. The offset to that is that the median grant percentage is 80%. Nonetheless, they’re succeeding in keeping loans down.

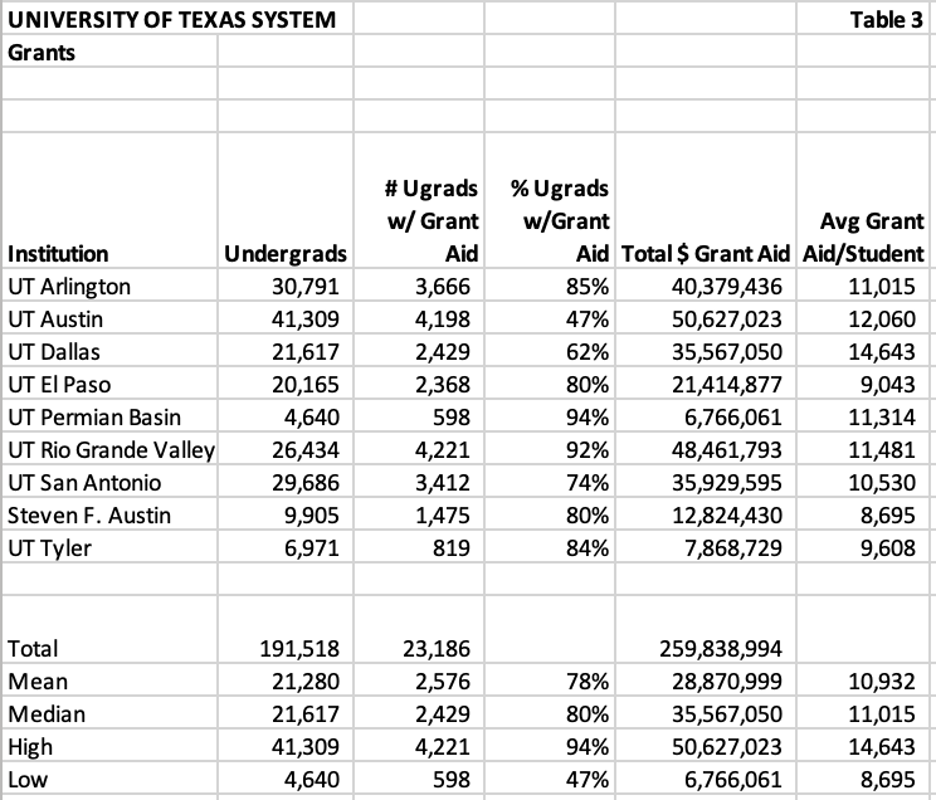

Table 3 below provides more specific details for grants issued to full-time first-year undergraduates at each of the institutions. UT Permian Basin has the highest percentage of students with grants (94%), and UT Austin has the lowest percentage of students with grants (47%). The latter percentage is likely due to UT Austin’s high percentage of students with no aid (31%).

The highest average grant award per student is $14,643 at UT Dallas, and the lowest is $8,695 at Steven F. Austin State University.

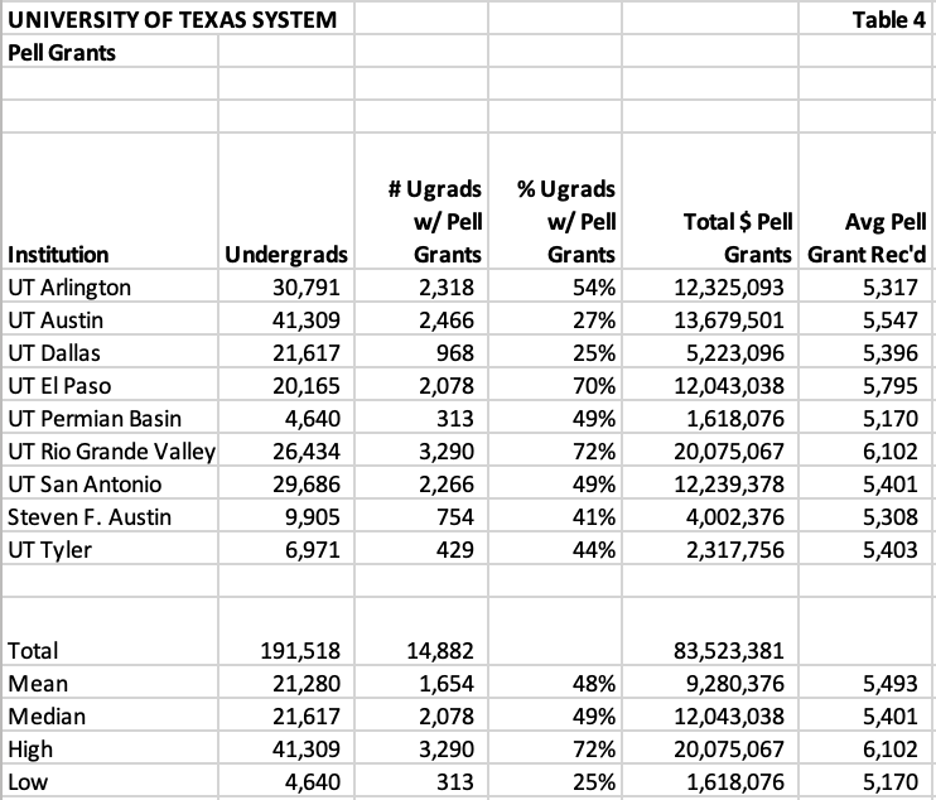

Table 4 below illustrates details about Pell grants issued at each of the nine institutions. The highest percentage of first-year, full-time students receiving Pell grants is 72% at UT Rio Grande Valley. The lowest percentage of students receiving Pell grants is 25% at UT Dallas. UT Austin’s Pell Grant percentage is 27%. The group’s median is 49%.

Table 5 below provides more data about undergraduate student loans at the UT System institutions. The percentage of first-year, full-time students receiving student loans ranges from a high of 47% at Steven F. Austin State University to a low of 14% at UT Rio Grande Valley. UT Permian Basin edged out Steven F. Austin State University for the highest median loan at $5,480. I am impressed with the Texas System’s median loan percentage of 28%.

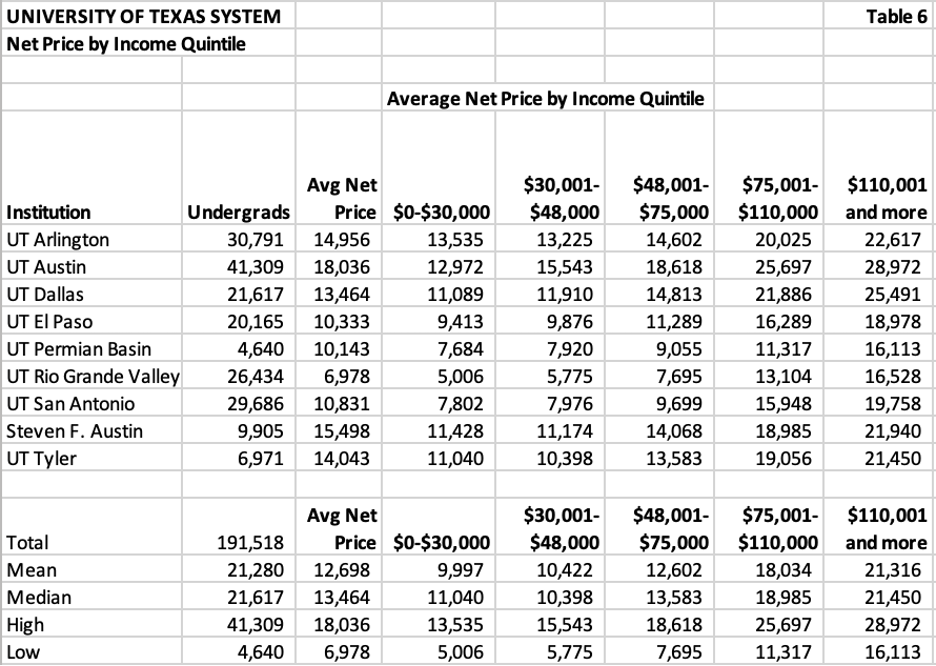

One of the first data points I look for when reviewing a college’s financial aid awards is the average net price and the average net price for the five income quintiles. Table 6 below provides those data points for each of the nine institutions, as well as the mean, median, high, and low.

The data in Table 6 does not conform to my earlier analyses, where the most expensive institutions had the lowest net prices in the lowest three quintiles. Instead, the lowest awards belong to UT Rio Grande Valley ($5,006 for <$30k), UT Permian Basin ($7,684 for <$30k), and UT San Antonio ($7,802 for <$30k).

One explanation for the average net price for these three institutions is that they serve a high percentage of Hispanic students. Hispanic families try to avoid borrowing, so these institutions may issue higher grants to attract local students.

The two institutions with the highest net prices in the highest quintile, UT Austin and UT Dallas, also have the highest percentages of full-pay students.

Final Thoughts

I commend MIT for its continued focus on making college affordable for needy students. Its high selectivity means that not many lower-income students will qualify for admission, but at least they can afford to attend if admitted.

I applaud the Texas System’s initiative to expand the income eligibility of its undergraduates who receive full tuition grants. At the same time, the grant is for tuition only. As illustrated in Table 1, median tuition of $10,600 is only 40% of the median COA of $26,804. With median grants of $11,015 (Table 3), there is still a shortfall.

Balancing financial aid awards with students’ needs is a delicate act. The data from my previous analyses and this analysis indicate that very few institutions meet the out-of-pocket needs of their lowest-income students. The 12 Ivy Plus institutions have the lowest net prices for the lowest quintiles, but few are at $0.

I suspect that more selective institutions, such as the 12 Ivy Plus, can confidently award more financial aid to the lowest-income applicants (who meet their highly selective criteria) than non-selective institutions. Colleges want to admit students who can graduate, and lower-income students are considered a higher dropout risk.

However, UT Austin is the most selective institution in the nine-member System, with a 29% admit rate. It has the highest average net price, $18,036, but also the second highest average net price ($12,972) for the $0-30k income quintile. It’s not following the lead of the Ivy Plus institutions.

Perhaps UT Austin’s award averages are related to its obligation to admit the top 6% of every Texas high school graduating class. Its average loan of $5,138 (Table 5) won’t make up the difference and students in this income quintile will not have savings or earnings either.

Is increasing the income limit for free tuition a great deal for students? Yes. Is it going to cover all a student’s education expenses? No.

If we don’t cover all expenses, not just tuition, will we have a solution that works for our lowest-income families? No.

Will we ever have such a solution? I’m not optimistic.

There are many changes afoot in higher education. MIT’s leadership role among the Ivy Plus sets an example. Sadly, only so many students can be admitted to these highly selective institutions.

The UT System is one of the wealthiest public university systems. It’s setting an example on the tuition side. Hopefully, it will attempt to follow MIT’s lead on the other expenses beyond tuition. More colleges and universities will follow if we have more examples of why this is important.