The Wall Street Journal published a series of articles in 2021 about the costs of graduate degrees and the income earned by graduates of those programs. I wrote a series of six blog articles that reported on and commented about their articles and the data presented in their reporting tool.

These posts included:

- Incurring Debt for Master’s Degrees – Where Is It Working?

- The Master’s Degree and Checking ROI After Student Graduation

- Evaluating Grad Students’ ROI – Are Law Schools Failing?

- More Analysis of Law School Debt and Earnings Data

- Does the Medical Profession Warrant High Student Debt?

- Graduate School Loans: An Overview of Problems and Solutions

Georgetown University’s Center on Education and the Workforce frequently provides detailed research related to the affordability and return on investment of college degrees. Articles I’ve written about their research in the past include Buyer Beware – First-Year Earnings and Debt for 37,000 College Majors at 4,400 Institutions and A First Try at ROI: Ranking 4,500 Colleges.

Recently, the Center issued another report titled Graduate Degrees – Risky and Unequal Paths to the Top. The report’s researchers and authors are Artem Gulish, Catherine Morris, Ban Cheah, and Jeff Strohl. The citation for the report’s tables and figures that I incorporated in this overview is:

Source: Artem Gulish, Catherine Morris, Ban Cheah, and Jeff Strohl. Graduate Degrees: Risky and Unequal Paths to the Top. Washington, DC: Georgetown University Center on Education and the Workforce, 2024. cew.georgetown.edu/graduatedegrees.

Does the Report Add Any News About Grad Programs?

Two sentences in the report’s first paragraph highlighted what many of my colleagues and I already know:

- “Graduate degrees – which include master’s, professional, and doctoral degrees – offer the highest earnings prospects and best chance of finding employment of all educational credentials.”

- “However, the growing costs of attaining a graduate degree have diminished the returns that accrue to graduate degree completers.”

The researchers wrote “minimizing the risks to borrowers will require closer regulatory scrutiny and greater transparency about graduate program outcomes.” When I read this, I wasn’t sure that I agreed with either point.

There’s a lot of transparency when you consider that all the Wall Street Journal data that I wrote about three years ago was sourced from the consumer-oriented College Scorecard. Do we need colleges and universities to link to that data? Perhaps. Do we need more regulations? This paper did not convince me to answer “perhaps.”

GradPLUS Loan Program

The researchers launch a discussion of the Grad PLUS Loan Program. In 2023, I critiqued an article written by Preston Cooper titled Why is Graduate School So Expensive? Mr. Cooper wrote that a new research paper authored by three economists examined the impact of GradPLUS on borrowing and tuition.

After GradPLUS was created, students increased their borrowing. Universities captured most of the increase in borrowing by increasing tuition. The economists calculated that 64% of the additional loans went directly to the universities. Mr. Cooper recommended eliminating the GradPLUS loan program and restoring a more reasonable cap on loans.

Part of Cooper’s research indicated that colleges with more than $50,000 per student in endowment funds enrolled 29% of all grad students but collected nearly 50% of all GradPLUS dollars borrowed. He recommended applying gainful employment regulations to all schools regardless of their tax status.

Adding More Regulations: A Good Idea?

While Cooper proposed expanding an existing set of regulations, the CEW researchers propose an entirely new set of regulations that they declare to be reasonable. CEW sets the stage by stating that Direct Unsubsidized Stafford loans account for 68% of annual federal loans disbursed to grad students. Grad students can borrow up to $20,500 annually and up to $138,500 in the aggregate for both undergrad and graduate studies.

According to the CEW researchers, GradPLUS loans are used by students who need additional funding after exhausting their borrowing through the Direct Unsubsidized Stafford Loan Program. Students can borrow up to their program’s cost of attendance, with no annual or aggregate limits.

Unlike Mr. Cooper who proposed eliminating GradPLUS loans (a recommendation that I concur with because I believe the program enables colleges to charge outrageous tuition), the CEW researchers state that GradPLUS provides a source of financing for students who have reached their Stafford loan limit, thereby facilitating access to graduate education.

If GradPLUS did not exist, students who use it would have to seek private loans which offer fewer protections. Interestingly, there is no mention of attending a more affordable college.

The researchers write that thanks to the high level of borrowings allowed under the GradPLUS program, colleges have limited incentive to keep costs in line with expected earnings. They also acknowledge that borrower protections such as income driven repayment options do not reach the root causes of the student debt problem. Institutions are not held accountable for poor outcomes and students are not discouraged from enrolling in programs that expose them to “financial adversity.”

The regulations proposed by the CEW researchers mirror the 2023 Gainful Employment regulations (Mr. Cooper recommended modifying GE instead of adding new regs). They claim their proposed measures are “more stringent” than GE and are designed to mediate access to GradPLUS loans rather than to Title IV (If GradPLUS is not eliminated, I might be able to concur with this strategy).

Researchers Propose Two Tests

There are two tests proposed by the researchers.

An In-field earnings premium test would require that program graduates have median earnings that are at least 5% above the median earnings of young workers (ages 25-34) who are not enrolled in college and who hold bachelor’s degrees in the same field of study in the state where the institution is located.

A debt-to-earnings test would require that median graduate federal loan payments not exceed 10% of program completer’s median discretionary earnings. The latter is defined as earnings above the living wage for a single individual without children in the state where the program is located.

If a graduate program fails either test for two or three consecutive years, its students will not be able to receive funding from GradPLUS loans. All grad schools will be required to inform prospective students of their performance on these two tests. Students who enroll in programs that fail either test will have to sign a document confirming that they were informed of the fact.

CEW claims that grad students want this level of transparency (who wouldn’t?). They also claim that a more restrictive standard would be overly restrictive. I don’t know. Allowing graduates to only improve their earnings by 5% over the median earnings of bachelor’s degree graduates is a very low standard. I assume grad students have higher expectations.

When justifying the “lower standard” they propose, the researchers note that “we believe that such an approach would be overly restrictive, limiting individual choice for students who may want to pursue graduate education options with lower earnings due to academic or personal interests.” Why should that “hall pass” exist in this schema when it doesn’t in Gainful Employment?

How Does the Test Impact Existing Graduate Programs?

The researchers used data from College Scorecard to assess their tests’ impact. Among programs with earnings data, 14% of master’s degree programs and 4% of professional degree programs do not pass the earnings premium test. Notably, 41% of master’s programs and 67% of professional programs do not pass the debt-to-earnings test.

The report’s researchers note the weakness of using data from the College Scorecard. To protect privacy, earnings from graduates of 77% of master’s programs, 70% of professional programs, and 93% of doctoral degree programs are suppressed.

They recommend that the Department of Education institute a pass/fail approach on the two tests to force the Department to hold more programs accountable.

Additional Policies Recommended

While the researchers propose using data from the derided and data limited College Scorecard, they also suggest additional metrics be included in the program data it collects. They propose the following:

- Outcome metrics including completion rates, withdrawal rates, loan repayment rates, the share of students with loans, the breakdown of loans held at the time of completion by loan type and by when the loans were taken out (during graduate or undergraduate studies), the primary occupations for which the program prepares students, and any post-graduation licensure requirements.

- Using targeted grants to promote graduate education in socially valuable but lower-paid professions and to support graduate students from marginalized and underrepresented groups.

- Requiring all institutions to provide adequate career and financial aid counseling to graduate students.

- Requiring graduate programs to report the same basic information as undergraduate programs to the Department of Education including admissions rates, retention rates, graduation rates, financial aid awards, and net price.

The researchers argue that greater transparency is necessary because graduate enrollments increased by 49% from 2000 to 2020. To meet increased demand, colleges expanded their graduate degree programs.

There’s a reason that demand for graduate degrees increased. Adults with graduate degrees have higher employment rates compared to adults with other education levels (87% vs. 75%). Workers with graduate degrees have higher earnings compared to workers with other education levels ($99,000 vs. $78,000 for BA and $46,000 for H.S. degrees).

The earnings premium for graduate degree holders relative to bachelor’s degree holders has not changed much over the past three decades except for doctoral degrees. However, the costs to earn a graduate degree since 2000 have tripled. Graduate loans comprise 50% of all student loans disbursed.

Graduate Healthcare Programs Require Special Considerations

The researchers note that graduate healthcare programs are major contributors to student loans. Among graduate degree completers, 54% of those in healthcare programs have more than $45,000 in graduate loans while 54% of those who studied in any other field do not have any graduate loans.

Most graduate healthcare program loans are not through GradPLUS but through a special Stafford loan program for healthcare program graduates. Due to residency requirements, healthcare professionals’ earnings tend to be lower in their early careers than in mid-careers.

The researchers note their GradPLUS proposals will not impact healthcare but suggest federal policymakers consider a separate standard.

Systemic Inequities Are Evident in Degree Attainment and Earnings Gaps

The researchers blame the inequities of the pre-K through 16 educational system on the lower percentage of Hispanic degree holders (8% vs 17% of adult population), and Black/African American degree holders (9% vs. 12% of adult population).

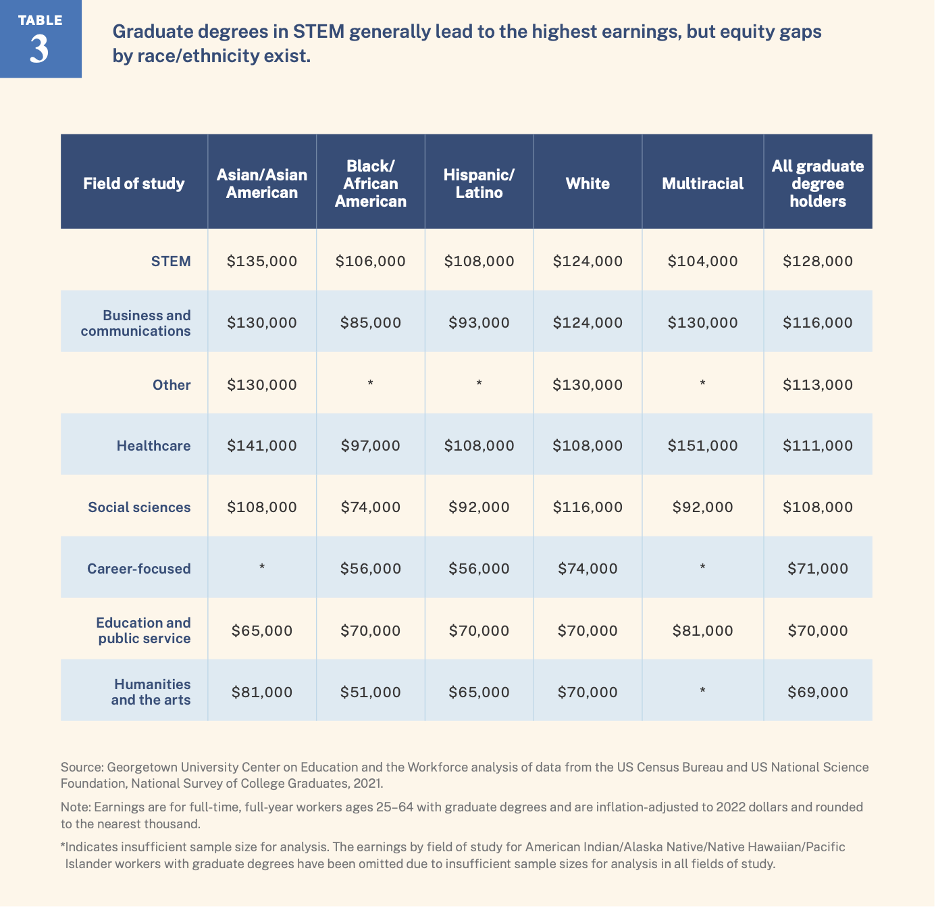

They note that graduate degrees do not lead to equal pay for these groups either. Each of these two groups and American Indian/Alaska Native graduate degree holders have median annual earnings of $85,000 or less while white and Asian/Asian American grad degree holders earn more than $100,000.

Women are credited with driving the growth in graduate education, with their share of graduate degrees increasing from 35% in 1970 to 61% in 2021. The number of women graduate students grew by 370% over that 30-year period, while the percentage of male graduate students grew by 57%.

Earnings inequities are greatest among women who hold graduate degrees. The earnings disparity in the general population shows women earning 80% of what men earn. Among the population that has earned graduate degrees, women only earn 71% of what men earn.

Substantive Data Presented in Six Parts and Two Appendixes

Like many previous CEW reports, Graduate Degrees: Risky and Unequal Paths to the Top, includes substantial data. The major data points and recommendations are included in the 17-page introduction. To glean a better understanding of the researchers’ reasoning, I recommend you read each of the six parts following the introduction.

Reading through these sections, I was occasionally dismayed to read through statements that expressed bias or contempt without data to support them. I’ll note them as I summarize each.

Part I: The Value of Graduate Degrees

Part I begins with the statement, “Graduate education is increasingly vital to the US economy and the workforce.” Citing higher earnings as a driver of higher spending and tax revenues, the researchers note that the rapid growth of graduate degrees has led some to question whether institutions are putting their financial interests first.

I’m good with the researchers asking that question. I do not agree with the statement: “These concerns are especially salient in the case of online master’s degree programs operated by third-party, for-profit online program management companies.” Where’s the evidence? All those OPM contracts were approved by the non-profit institutions offering them.

The researchers note that the graduate-to-bachelor’s degree earnings premium has not increased in the last three decades except for doctoral degrees. Let’s be blunt and ask if the increase in supply has outstripped the demand leading to no gain in wage premium. That’s what the colleges that increased their net tuition by 300% should be asking.

Currently, 14% of jobs require graduate degree holders. The researchers predict that percentage will increase to 16% by 2031, and the number of jobs requiring a graduate degree will increase by 5.2 million over that period.

The researchers note that graduate education was insignificant at US colleges until the middle of the 20th century. The post WWII GI Bill, the National Defense Education Act (NDEA), and the Higher Education Act (HEA) provided loans for students to achieve graduate education.

By 1969-1970, US colleges awarded 214,000 master’s degrees and 59,000 doctoral degrees. Graduate enrollments grew 300% from 1.2 million in 1970 to 3.2 million in 2021.

The researchers mention that the number of fields requiring a post-graduate degree for licensure grew in the 21st century. They cite occupations like certified registered nurse anesthetists, athletic trainers, registered dieticians, and occupational therapists. I would add physical therapists, pharmacists, nurse practitioners, physician’s assistants, and speech therapists.

“Institutions also see graduate degrees as a lucrative part of their business model.” At least the researchers acknowledge that colleges have a business model. They note that in 2019-20, public colleges received $18,580 in revenues from every full-time master’s student and $30,890 from every full-time doctoral student.

The researchers compare the graduate tuition revenues to the $15,150 received for every full-time bachelor’s degree student and the $11,350 from each full-time associate’s student. They also note that the tuition discount at private institutions is much less for grad students (17% in 2019-20 vs. 44% in 2019-20).

The researchers conclude that master’s degrees bring in more revenue at lower costs than bachelor’s degrees based solely on the tuition discount percentage at private institutions. Maybe that’s true for private institutions, but I’m not sure the public institution data supported that statement.

When the financial incentives for master’s degrees are combined with weak regulatory requirements, the researchers note that some critics question universities’ motives for offering them. Several critics are quoted.

Having sat on several non-profit college boards, I think all of them understand that increasing enrollments is an important factor in growing revenues. Why it’s nefarious and why weak regulations are cited is questionable. Colleges are in the business of education. They understand accreditation and regulations.

“Students have clear monetary incentives to pursue graduate education.” No surprise here. That fact has been evident since I attended college in the 1970’s. “Median earnings vary by graduate degree type.” No surprise again. My Duke undergraduate classmates overwhelmingly attended graduate law schools, medical schools, and business schools.

Part II: Fields of Study and Occupations

Clearly this section was inserted to provide specific data to readers because it’s been widely known for years that certain graduate degrees lead to higher incomes than others. Stating that occupational demand is an important factor to consider when selecting a field of study may be helpful for researchers but not the key decision factor for a student.

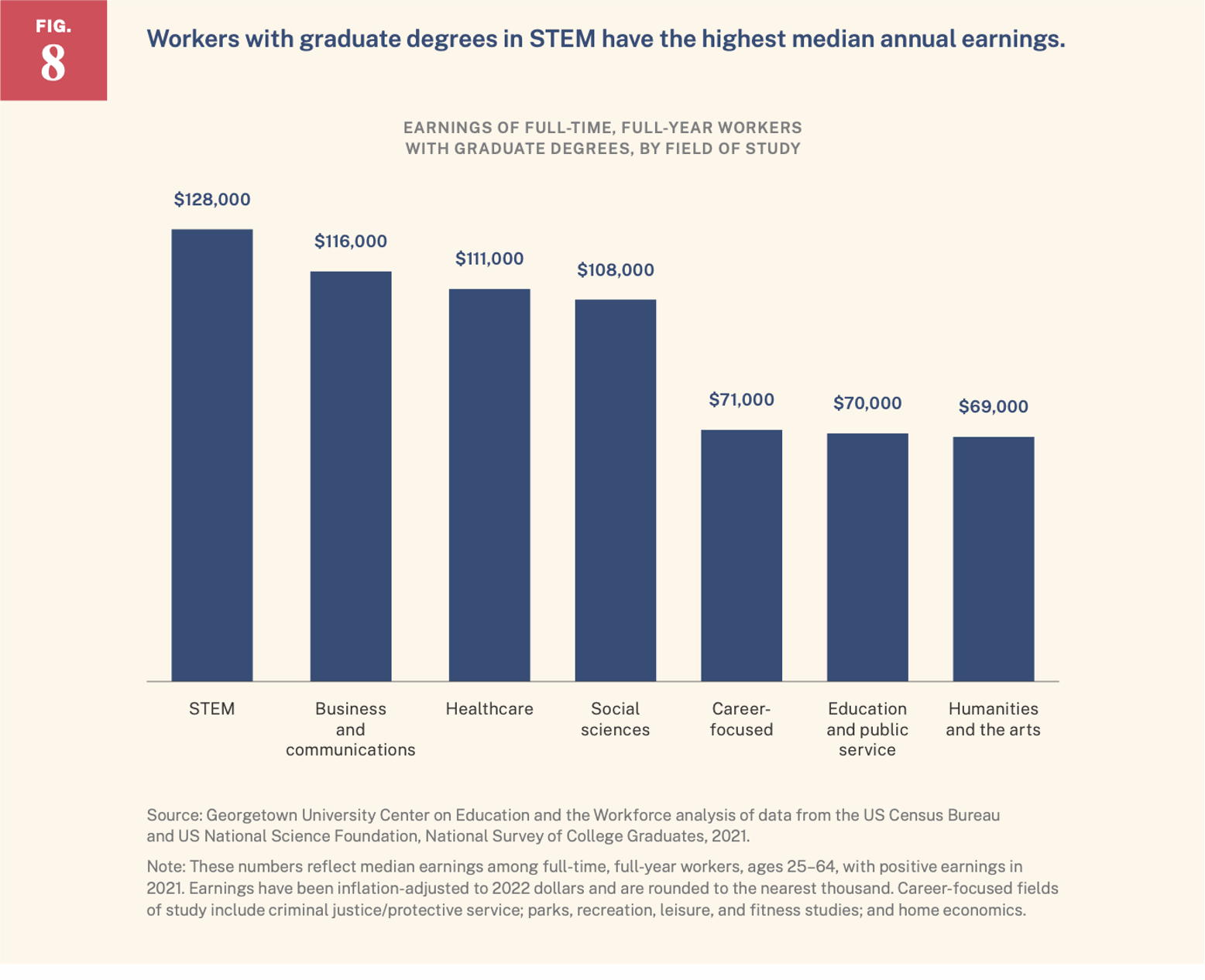

Figure 8 from the report is appended below to illustrate the variance in median earnings by degree field. This data is not surprising to me.

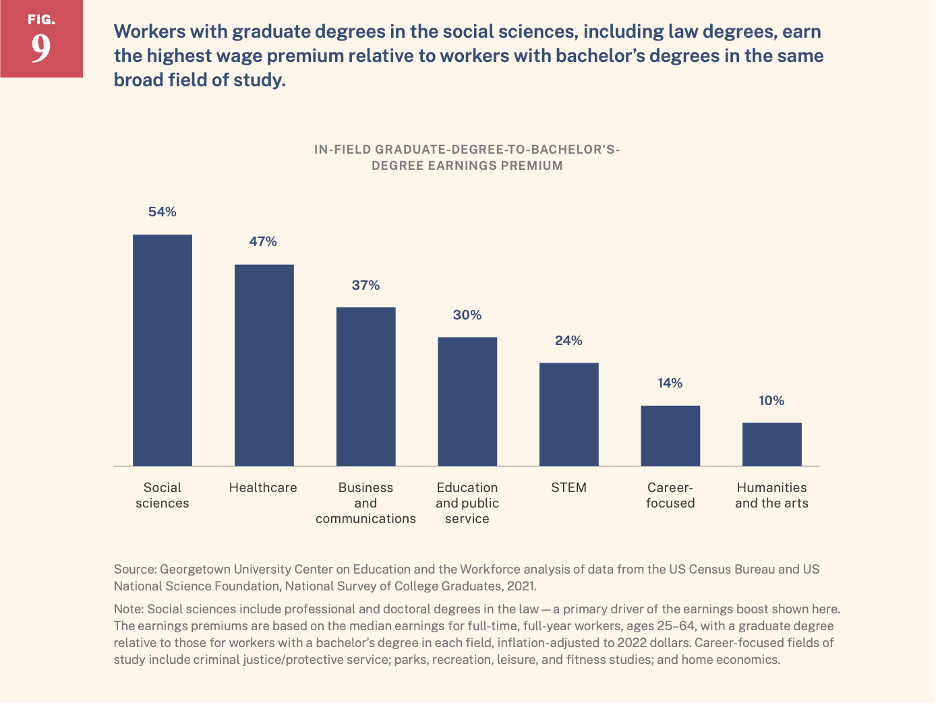

Another interesting datapoint relates to the comparison of earnings of workers with graduate degrees relative to workers with undergraduate degrees in the same field. The highest premium in social sciences is driven by law school graduates. Workers with graduate degrees in humanities may have been motivated by interest, not earnings.

The researchers provided a separate section related to master’s degrees in education. Master’s in education degrees are the second-most conferred degrees next to MBA’s. Their research indicates that graduate degrees in education and service lead to median earnings of $70,000 which is a 30% increase over the median of bachelor’s in education degrees.

The researchers note that evidence does not conclude that master’s degrees in education lead to higher teacher quality. Even though the evidence of an earnings premium exists, the researchers note that master’s degrees in education provide a steady income to the colleges that offer them.

The researchers suggest that school districts should only offer pay increases to teachers who attended graduate programs that have been proven to strengthen teacher quality. In an era of teacher shortages, I doubt many districts will embrace that recommendation.

Education is the most popular graduate degree, but the researchers predict that will shift by 2031 to managerial and professional office occupations. The data by occupational cluster is appended below in the report’s Table 1.

Part III: Cost and Debt

Leading off this section is the statement: “as of 2021, graduate students were 21 percent of borrowers but received 47 percent of federal student loan disbursements.” The researchers write that “net tuition and fees represent the direct costs students actually pay for a degree program.”

Direct costs have tripled over the past 20 years from $3,000 per year in 2000 to $10,000 per year in 2020. During the same period, median cumulative graduate school debt increased from $34,000 in 2000 to $50,000 in 2020. Cumulative graduate school debt may understate the debt burden of graduate students who borrowed loans for their bachelor’s degrees.

According to the researchers, the Congressional Budget Office states that graduate loans will grow by $521 billion between 2023 and 2033. The federal government is expected to forgive 56% of the loan amounts disbursed between 2020 and 2029 through income-driven repayment plans.

Interestingly, high graduate debt is not an issue for all borrowers. The largest growth in borrowing is concentrated in the top quartile of borrowers. Between 1996 and 2020, the 75th percentile increased their loans from $61,000 to $96,000, and the 25th percentile increased their loans from $19,000 to $25,000.

Graduate students in the healthcare field are more likely to borrow (73%) than grad students in all other fields (53%). Healthcare grad students have a median loan balance of $93,000 vs. $50,000 for all others.

GradPLUS loans account for less than one third (32%) of graduate loan disbursements. However, the amount of GradPLUS loans increased 91% between 2014 and 2022. GradPLUS borrowing is more common for students enrolled in expensive programs. GradPLUS borrowers are more concentrated at private, non-profit colleges.

Lower-income students tend to be overrepresented, with 68% of GradPLUS borrowers completing their degrees earning less than $30,000 vs. 46% of all graduate students completing degrees. Grad PLUS loans have not moved the needle on racial/ethnic equality.

Part IV: Racial/Ethnic and Gender Equity Challenges

The section opens with the statement “an advanced degree confers great advantages in the labor market, but not all graduates benefit equally.” Cost and debt hurt historically underrepresented groups the most. These groups also earn less once employed. Racial/ethnic minorities are channeled toward fields of study with lower-paying jobs.

Racial wealth and income gaps make a difference in how much money families can contribute toward their children’s undergraduate and graduate educations. These gaps influence the likelihood a student will apply to a selective college/program, their choice of field of study, and their chances of receiving a high-quality entry level job.

Table 3 from the study is appended below and illustrates the differences in earnings by field of study between races.

The researchers note that low-income students are handicapped thanks to their pre-K through 12th education. Only 30% of students from the lowest income quartile who score in the top half of their 10th-grade math cohort will earn a bachelor’s in 10 years. This contrasts with 70% of the highest income quartile who score in the top half of the same cohort.

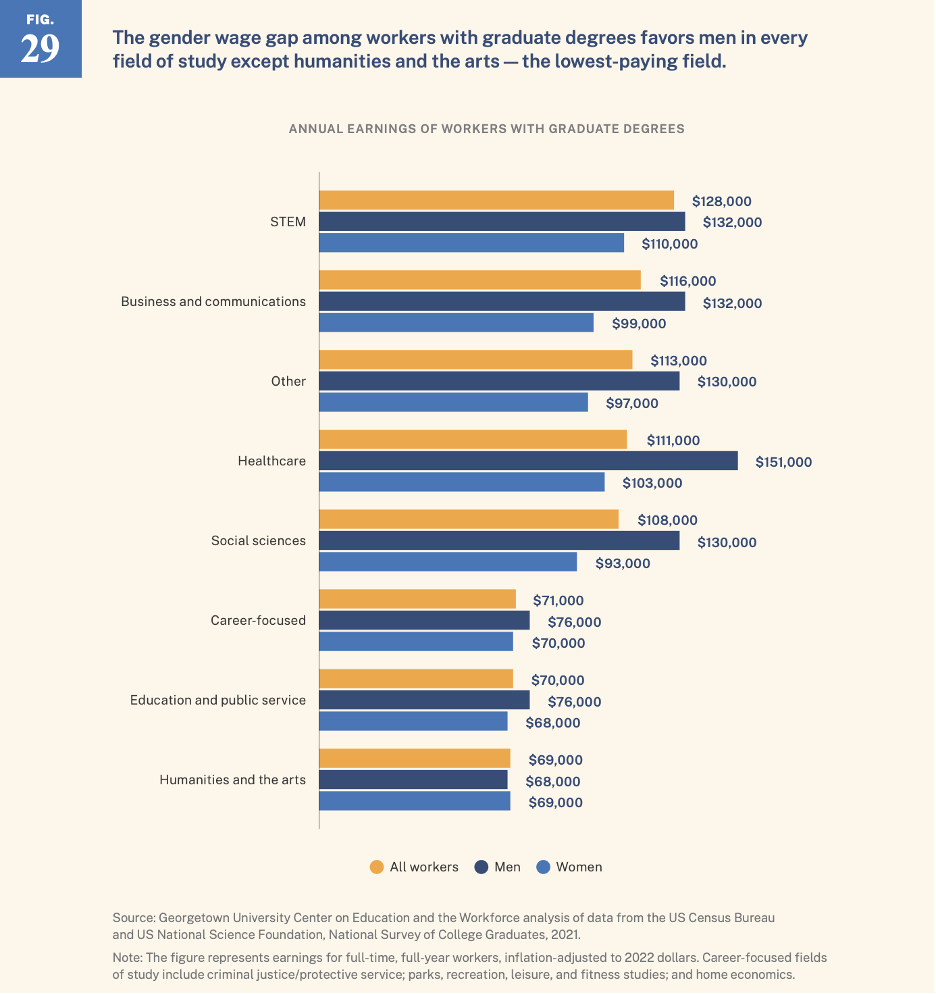

Women with graduate degrees earn $85,000 per year vs. $119,000 per year earned by men. Part of the explanation for this is the segregation by field of study. Women account for 73% and 63% of graduates in lower-earning fields like education, public service, and humanities and the arts.

Men account for 72% and 54% of workers in fields like STEM, business, and communications. Even when women are in the same field, they earn less than men. See Figure 29 from the report appended below.

Part V: Proposed Program-Level Regulatory Tests

The researchers applaud the Department of Education’s 2023 Gainful Employment (GE) and Financial Value Transparency (FVT) regulations for the greater accountability required to ensure that students don’t have too much debt with too low earnings.

Let’s be blunt: this regulation primarily applies to for-profits. It should apply to all institutions.

The researchers neglect to mention that GE applies primarily to for-profit institutions. They state that the current system fails to protect graduate students and creates “perverse incentives” for graduate program providers.

The researchers note that some policymakers have called for the elimination of GradPLUS loans or limits on federal graduate borrowing (I have called for the elimination of GradPLUS and ParentPLUS loan programs for years).

The researchers claim that eliminating GradPLUS loans would disproportionately impact students from lower-income and underrepresented racial/ethnic groups. Why?

Elimination supposedly would restrict their access to the private markets. My argument would be that elimination would force high-cost institutions to lower their costs; otherwise, students would attend low-cost institutions.

The earnings test proposed by the researchers proposes median earnings at least 5% above the median earnings of workers aged 25-34 who are not in grad school and who hold a bachelor’s degree in the same field of study in the state where the institution is located. They claim this is a stricter standard than the GE and FVT regulations. I am not sure.

According to the researchers, a stricter standard would be overly restrictive and limit student choice. They write “some students may want to pursue graduate education in programs that yield lower earnings premiums but that align with their academic interests or professional goals.” That makes sense to me but why isn’t it in the GE regs that they support?

The GE and FVT regulations only consider tuition, fees, and equipment and supplies required for coursework. The CEW proposal considers all a completer’s graduate debt. CEW claims that their proposal is intended to address issues like whether borrowers can afford their debt payments. Why don’t they propose a cap to keep borrowers from using the program to purchase non-educational items?

I love the box that describes the limitations of the College Scorecard data. I agree with:

- It reflects the outcomes only of Title IV federal financial aid recipients (it should include data from non-borrowers).

- It does not include data on earnings and debt for small programs due to privacy considerations.

As a result of the second limitation, there are many degree programs that are excluded from the CEW analysis. The researchers report that 14% of master’s degree programs with available data and 4% of professional degree programs would fail their in-field earnings premium test. In my opinion, that’s not enough for a program that allows virtually unlimited borrowing.

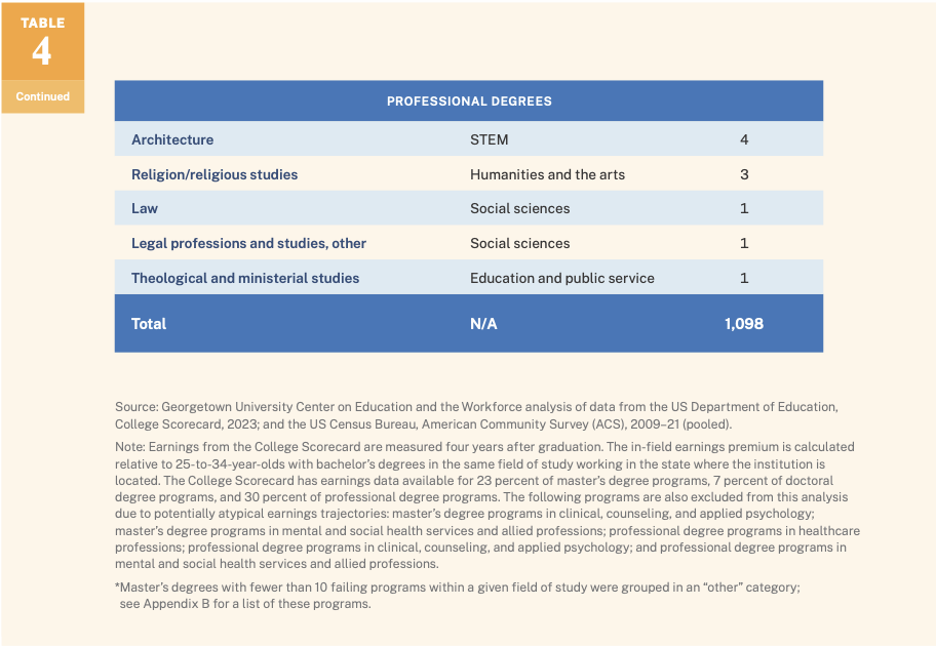

The fields of study with the largest number of programs failing the earnings premium test are shown in Table 4 from the study appended below.

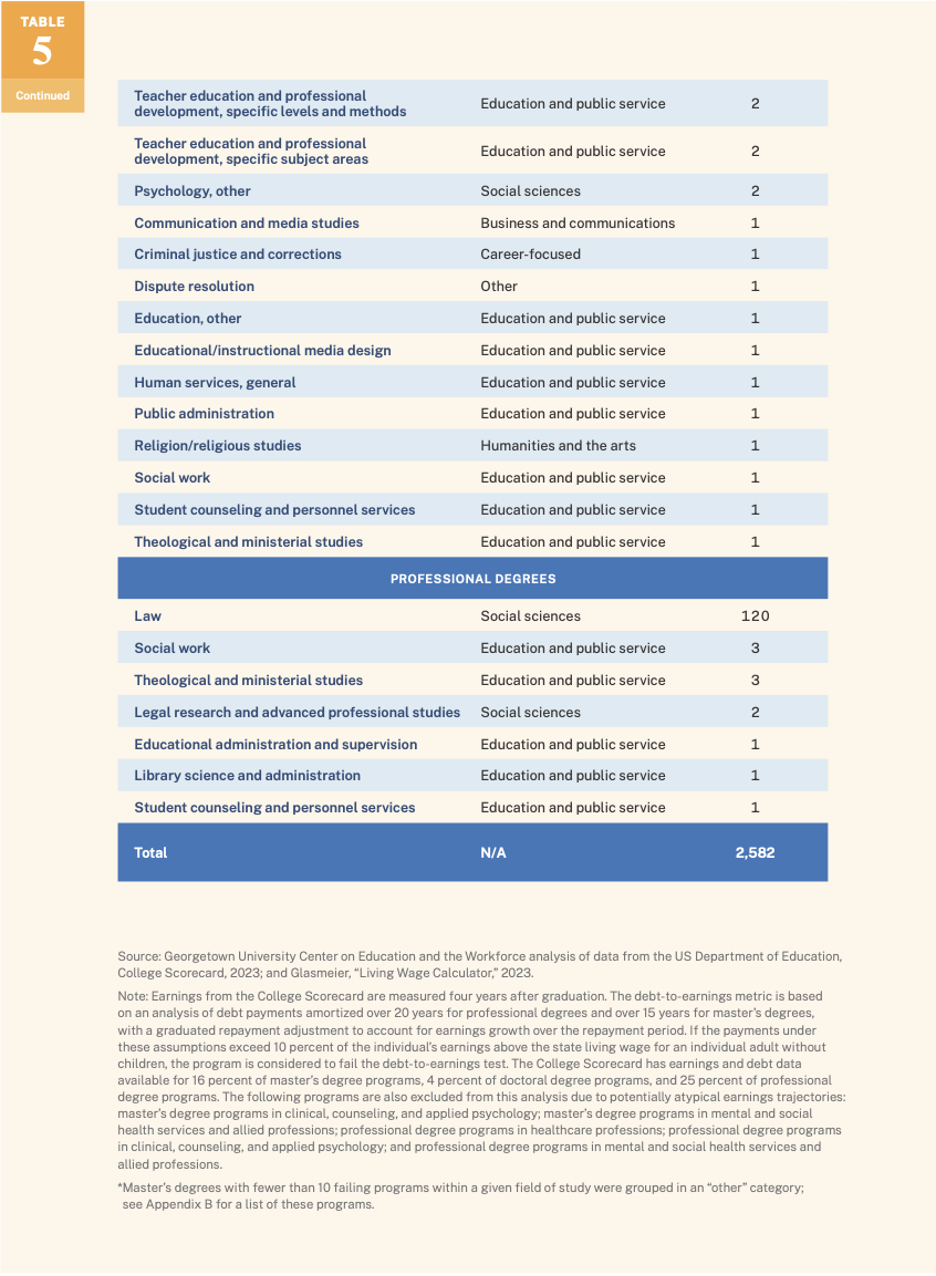

There are two tests, however, and the researchers report that 41% of master’s degree programs and 67% of professional degree programs would fail the proposed debt-to-earnings test. The degrees that would fail are listed in Table 5 below.

While the percentage of programs failing the debt-to-earnings test is high, the percentage of programs with enough data represent only 16% of master’s programs and 24% of professional degree programs.

The researchers know the colleges at which the failing programs reside. For further research, it would be interesting to see if specific institutions have multiple failing programs indicating a propensity to charge more.

Part VI: Additional Policy Recommendations

CEW’s researchers provided additional recommendations beyond their two tests. They write “the onus of funding the credentials necessary for fields like teaching, counseling, and social work falls largely on the individuals who choose these vocations. Acquiring a degree takes time and money, and earnings in some of these fields have not kept up with rising expenses.”

As a result, the researchers recommend that federal and state governments should provide targeted grant aid to support graduate education in socially valuable professions. The grants they recommend would go to graduate students upfront and require that they work in the targeted profession after graduation.

The proposal would convert grants to loans if the recipients failed to meet the agreements to work in the field post-graduation. Grants are better than loan forgiveness if there is a goal to expand the number of workers in that area.

Another proposal from the researchers is to expand the transparency of the graduate program outcomes. Potential students would receive information about:

- The primary occupations for which the program prepares students,

- The program completion rates,

- The program withdrawal rates,

- The loan repayment rates among borrowers,

- The share of students who have loans,

- The breakdown of all loans held by graduate borrowers by graduate and undergraduate share, and

- Any relevant post-graduation requirements for licensure or entry into the occupations for which the program prepares students.

I like this proposal, but if it is subject to the same data privacy rules as the College Scorecard, the percentages of programs with data displayed will be less than half.

An additional proposal is that colleges and universities should be required to submit to the Department of Education the same information about graduate programs that they report on undergraduate programs. This includes all data necessary to calculate admission, retention, and graduation rates.

It also includes submitting the amount of financial aid provided to graduate students and the net prices students pay. The data would be disaggregated by race/ethnicity and gender. A reason for recommending the latter is cited as important in the wake of the Supreme Court’s 2023 decision to end race-conscious affirmative action in admissions.

The researchers mention the limitations of College Scorecard data. Not optimistic that the Department of Education will include more data, they suggest that the Department consider implementing a pass/fail approach on metrics such as the earnings premium and the debt-to-earnings for smaller programs without compromising privacy.

The long-stalled College Transparency Act (CTA) is cited. If passed, the CTA would lift the student unit record ban and create a data system that would include all college students, not just those who receive federal aid. As a result, the number of completers would likely increase, increasing the number of programs with data. I have supported this for years.

The CEW researchers note the importance of subsidizing health care programs. At the same time, they recommend that Congress and the Department of Education review whether the higher borrowing limits for healthcare programs are meeting the intended policy goals. They would also like the department to review whether there are better ways to achieve those goals and whether an accountability standard can be implemented without hurting public health or limiting the availability of graduate training for healthcare professionals. I support this as well.

CEW Conclusion

The researchers write “graduate student loan financing should not result in more students falling prey to high-cost programs that leave them with unaffordable debt and insufficient value in return.” I agree.

The report also states “eliminating GradPLUS loans—the only source of funding that allows many students from marginalized and underrepresented backgrounds to pursue some higher-cost graduate programs—is not the answer.” I disagree.

The researchers’ findings indicated that 41% of master’s programs and 67% of professional programs would fail their debt-to-earnings test. They discount this finding by stating how few programs provide data through the College Scorecard. I maintain that it is likely that the smaller programs have similar if not worse outcomes for the debt-to-earnings test.

Findings of this significance indicate that the GradPLUS program encourages colleges and universities to charge more than they normally would and encourages borrowers to borrow more. I continue to believe that the GradPLUS program should be discontinued.

Final Thoughts

As usual, the CEW provides useful data for a research paper. I support the transparency recommendations for graduate programs that the researchers suggest. I am not a fan of the first test because the increment is too low for the most expensive graduate programs. I support the second test but believe that the ultimate outcome—the college cannot use the GradPLUS for students enrolled in that program—is too weak.

The 2023 Gainful Employment rules could be applied to graduate programs and used to winnow down the programs that are too expensive and provide graduates with limited earnings outcomes. If there are programs such as social work that we should support, federal grants such as those proposed by the researchers to reduce debt are a good idea.

I have always believed that Gainful Employment would be a better standard if all colleges had to abide by it. I thank the CEW for giving me an excellent reason to propose that we use it instead of adding another regulation that supports a loan program that supports wealthy institutions charging students too much money.