The trials and tribulations of small college economics are not something new. Pre-pandemic, Bob Zemsky, Susan Shaman, and Susan Baldridge published The College Stress Test outlining a methodology to determine whether or not a college was in financial difficulties.

The College Stress Test Methodology

For the four-year, private non-profit sector, The College Stress Test created a market stress test score using four variables. Variable 1 is the annual enrollment of first-year, degree-seeking undergraduates. Variable 2 is the annual percentage of first-year students returning for a second year.

Eight years of Variable 1 data are used to plot an enrollment trend line. The slope of that line is used to project the enrollment for three years in the future. Variable 2 data are plotted for the same eight-year period and that line’s slope is used to project another three years as well.

Variable 3 is the average tuition and fees the institution receives after applying the average discount from institutional financial aid (noted as market price; also similar to net price). The change in market price over the eight-year period is charted. A declining average market price reflects an institution’s difficulty in recruiting a new class at the same net price as the previous year(s).

Variable 4 is a ratio of endowment balance to total institutional expenses. It is computed by using the change over eight years in the ratio of the end-of-year endowment value to that year’s total expenses (excluding hospital expenses if a hospital is owned).

Professor Zemsky and his co-authors estimated that 10% of all colleges “failed” the stress test, and another 30% were barely passing. During the pandemic, Zemsky was interviewed by David Wescott and indicated that the 10% of colleges in extreme stress may have increased to 20%. Federal pandemic funding to colleges may have temporarily alleviated the stress for some.

NACUBO’s Tuition Discounting Study

The National Association of College and University Business Officers (NACUBO) has collected and published the tuition discount rate (a factor in the market price used by Zemsky et al as Variable 3) for many years in its annual tuition discount study. In the fall of 2022-2023, the first-year discount reached an all-time high of 56.2 percent.

Obviously, the greater the discount, the less a student is charged. Importantly, if a college’s student enrollments are flat, an increasing tuition discount means less cash to cover expenses. If the enrollment is declining at the same time, the situation is exacerbated.

Fitch Ratings – Smaller Colleges’ Enrollment Strategies

In a June 2023 report, Fitch Ratings writes that enrollment declines have to be addressed before reserves and other resources are depleted. A lag between new program development and revenue generation will stretch budgets instead of aiding them. Tuition resets, scholarship aid, and direct admissions are tools to attract students.

The challenge to implementing all the tools to attract increased enrollments is supporting college affordability for prospective students while maintaining a solid fiscal balance in an inflationary environment. Fitch writes that all colleges are maintaining a 2.3 annual debt service coverage ratio while colleges with less than 1,500 students have a 1.3 debt service ratio.

Waning interest in liberal arts, questions about student debt, questions about the value of a college degree, and a slowing economy contribute to the financial pressures faced by small colleges. Declining high school graduates are an additional factor for small colleges in the northeast and Midwest.

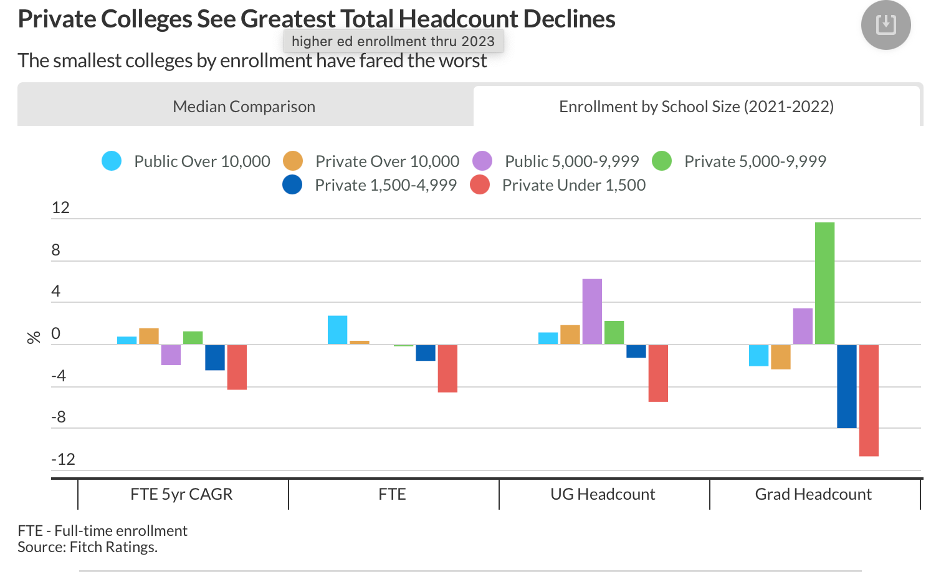

The smallest colleges by enrollment have experienced the greatest decline in enrollments over the past five years (see figure below).

Competition is fierce, and institutions need to carefully allocate adequate funding for any enrollment improvement strategy.

U.S. News College Finances “Red Flags”

U.S. News writer LaMont Jones penned an article published in June 2023 about two of the biggest financial red flags for colleges – crippling debt and deferred maintenance. Mr. Jones cites an EY-Parthenon 2021 report that questions whether the sector can sustain more debt financing.

Declining enrollments and negative operating margins are two of the key factors mentioned as reasons why many small and medium colleges’ debt burdens are contributing to their financial challenges. Congress provided $69 billion in Covid aid to nearly 5,700 colleges and universities. UNC Chapel Hill professor Paul Friga commented that “many schools failed to make strategic investments in technology or right-size to align expenses with declining enrollments.”

Mr. Jones cites a Gordian report about the State of Facilities in Higher Education that indicates deferred maintenance at U.S. colleges and universities represents a 36% shortfall. Contributing further to the problem is the high rate of inflation on construction-related costs. In some cases, buildings were financed with debt and enrollments have not kept pace to contribute to the cost of debt service and regular maintenance.

Bloomberg News Methodology

Last week, Bloomberg reporters Nic Querolo, Danielle Moran, and Marie Patino published an article about the faltering economics of small U.S. colleges. They reviewed data from more than 1,000 U.S. colleges with less than 5,000 students, continuing a study that has been conducted by Bloomberg for several years. There were 170 nonprofit colleges and universities that met three or more of the five metrics indicating increasing financial pressures.

Factor #1 reflects the share of applicants a school admits. An institution fails this metric if it admits an average of 80% or more of its applicants over three consecutive years.

Factor #2 reflects the share of students who accept offers of admission. If the three-year average yield rate of accepted applicants is 20% or less, an institution fails this metric.

Factor #3 reflects the enrollment of full-time undergraduate students. If an institution experiences three straight years of declining enrollment and loses at least 10% of full-tine students, it fails this metric.

Factor #4 reflects three straight years of increasing institutional aid to students. If the aggregate average increases to 10%, an institution fails this metric.

Factor #5 reflects three consecutive years of operating losses and excludes gains or losses from investments or endowments. An institution meets this metric (and fails) if it has three consecutive years of operating losses.

The Bloomberg authors found that 1% of all institutions failed three or more metrics in 2008. In 2021 (the year used for this article), 18% of all institutions failed three or more metrics. In 2008, 44% of the schools did not fail any of the metrics. In 2021, only 20% did not fail any.

One of the college presidents interviewed by Bloomberg said “you have an industry with falling demand and overcapacity. We would be foolish to expect anything other than consolidation and shakeout.”

Bloomberg’s authors pin the blame for increasing risk of closure to declining demographics and cite the fall in overall full-time undergraduate enrollment from 11.5 million in 2010 to 9.5 million in 2021. Since the U.S. birth rate did not decline until after 2007, the explanation for declining enrollments is likely higher prices or perceived lower ROI for college graduates.

Highlights of some of the metrics include:

- The median admission rate increased from 68% to 72% from 2008 to 2021.

- The median yield decreased from 36% to 21%.

Analysts interviewed by the authors described the higher education market as a barbell where top schools prosper, and bottom schools slip into greater distress. Schools at the bottom will need to differentiate themselves away from liberal arts offerings and more toward jobs-based and technical programs that serve an economic need.

The options are not good for students impacted by a school closure. They take longer to finish their programs and are 50% less likely to earn a credential than students attending an institution that stayed open. Students of color are less likely than white students to finish if their college closes.

Analysts interviewed by the authors indicated that the number of college closures are likely to increase.

4 Ideas for Struggling Colleges

Writing for Harvard Business School publishing in June 2023, Professor John Drea provided four ideas for every struggling college to consider.

Idea #1 – Focus on what sets you apart. Too many small colleges tell the same story to prospective students. Institutions should identify the institutions they believe to be their direct competitors, identify specific and measurable areas where your institution’s majors are differentiated from your competitors, and compare the differences between your majors and those of your competitors with the needs of prospective students. If you cannot identify major differences, you have work to do to distinguish your programs.

Idea #2 – Leave best practices behind. Copying a best practice strategy fails to consider differences in our institution’s context and students compared to other schools. Copying a best practice strategy means that you are behind those already implementing it. Student recruitment is competitive. Instead of copying tactics, develop strategies and achieve a first-mover advantage.

Idea #3 – Reexamine your approach to market segmentation. “We’ve reached a point when we must rethink how we segment higher education markets by looking for smaller groups with intense needs.” Coursera, Udacity, and other alternative providers have identified segments of students who seek lower costs, specific skills, and certification of those skills for improved career prospects.

Idea #4 – Rethink the role of career services. Colleges with a strong reputation for placing students in high-paying careers are likely to attract more students. Instead of thinking of career services as a cost center, think of it as a steppingstone to improving student recruitment as more students are successfully placed in well-paying careers.

Mr. Drea concludes his article by stating that poor college leadership is a greater challenge than declining student numbers, declining resources, poor economies of scale, and weakened external support. Great leaders will create an environment that encourages faculty, staff, and administration to innovate.

Is There a Miracle Solution for Small Colleges?

Early in my career, I was a financial consultant. I analyzed all types of corporate financial data, and the metrics with the highest potential return were included in a final report to the client. I remember one of my clients, a CFO, saying “you consultants have it easy. You analyze and make recommendations and we must implement them.”

There is no shortage of people analyzing the financial and operational metrics of colleges and universities. I’ve provided short reviews of a few of them. What are the options for a college president and CFO trying to avoid closure?

The dominant financial model for most colleges and universities has a high percentage of fixed costs. When enrollments decline, it is difficult to cut expenses quickly enough to offset the drop in tuition revenue and gross margin. If you can maintain enrollments but must increase the tuition discount rate to attract more students, that’s a problem as well.

NACUBO’s tuition discount study highlights the fact that many colleges have increased tuition discounts (or institutional aid) to maintain enrollments. The 18% decline in full-time undergraduate enrollments from 2010 to 2021 indicates that the discounts didn’t work as planned.

To offset enrollment declines and increases in tuition discounts, colleges must cut expenses. With a fixed cost model, that usually means cutting faculty by eliminating low enrollment programs and cutting staff through cuts in services or automation of some services or both.

Declines in net operating margins means that colleges with debt service obligations have fewer resources to cover debt service. Unless they have a large, unrestricted endowment balance or a generous donor, the chances of default increase.

Increased Competition

Most leaders of traditional colleges view their competition as colleges that look like their college. There are 5.8 million students attending college in a fully online format. Are they totally new to college? How many would have gone to a traditional college as recently as 10 years ago? This number is up from practically nothing three decades ago.

Many of the largest online universities were not viewed as competition three decades ago. It’s about time that someone acknowledges them as disruptive innovators, a term coined by the late Clayton Christensen years ago in his book, The Innovator’s Dilemma.

Alternative education providers have increased as well. The Credential Engine initiative tracks unique postsecondary credentials. Its most recent report lists 1,076,358 unique credentials. Only 356,412 are degrees and certificates from post-secondary educational institutions. Non-academic providers account for nearly two-thirds of reported credentials.

Ignore the Signs at Great Peril

I suspect that there are more institutions at economic risk than the 170 identified by Bloomberg in their article. I also suspect that the number exceeds the 10% number estimated by Bob Zemsky and his co-authors of the College Stress Test. I am willing to wager that most institutions in financial trouble are aware of their situation.

Raising money by increasing tuition is no longer an option for most colleges and universities. Cutting expenses may be an “easier” solution but not one without much pain and risk. Reengineering the business model is nearly impossible.

Institutions that are surviving but not thriving can’t rest on their laurels. Leaders should examine their institution’s strengths and focus on what differentiates it from the competition. Don’t expect a lifeline. Outwork your competition. Assume they’re trying to outwork you. The next decade will be vastly different than the last two.